As we close out January 2026, the markets are flashing mixed signals. We are in the thick of a chaotic Q4 Earnings Season, combined with renewed geopolitical headlines.

This week, search volumes and trading activity have spiked for three distinct tickers: Lockheed Martin (LMT), Palantir (PLTR), and Joby Aviation (JOBY).

It's not just speculation; specific catalysts are driving this volume. Here is the breakdown of what is moving these stocks right now and how you should react.

1. Lockheed Martin (LMT): The "Flight to Safety" Trade

LMT has seen heavy volume following its late-January earnings report. While the numbers were solid, the volatility is coming from sector rotation.

🚨 The Driver: Record Backlog & Geopolitics

- Earnings Aftermath: LMT reported a record-breaking order backlog. In an uncertain economy, investors are flocking to companies with guaranteed revenue for the next 5–10 years.

- The "Fear Trade": With tensions simmering in Eastern Europe and the Middle East this week, institutional algorithms are automatically rotating capital out of high-beta tech and into Defense prime contractors like LMT. It is acting as a hedge against broader market declines.

📉 Trading Strategy: Buy the Dip. LMT is currently behaving more like a bond with upside. If the broader market sells off, LMT is your shield. Any pullback is a buying opportunity for conservative portfolios.

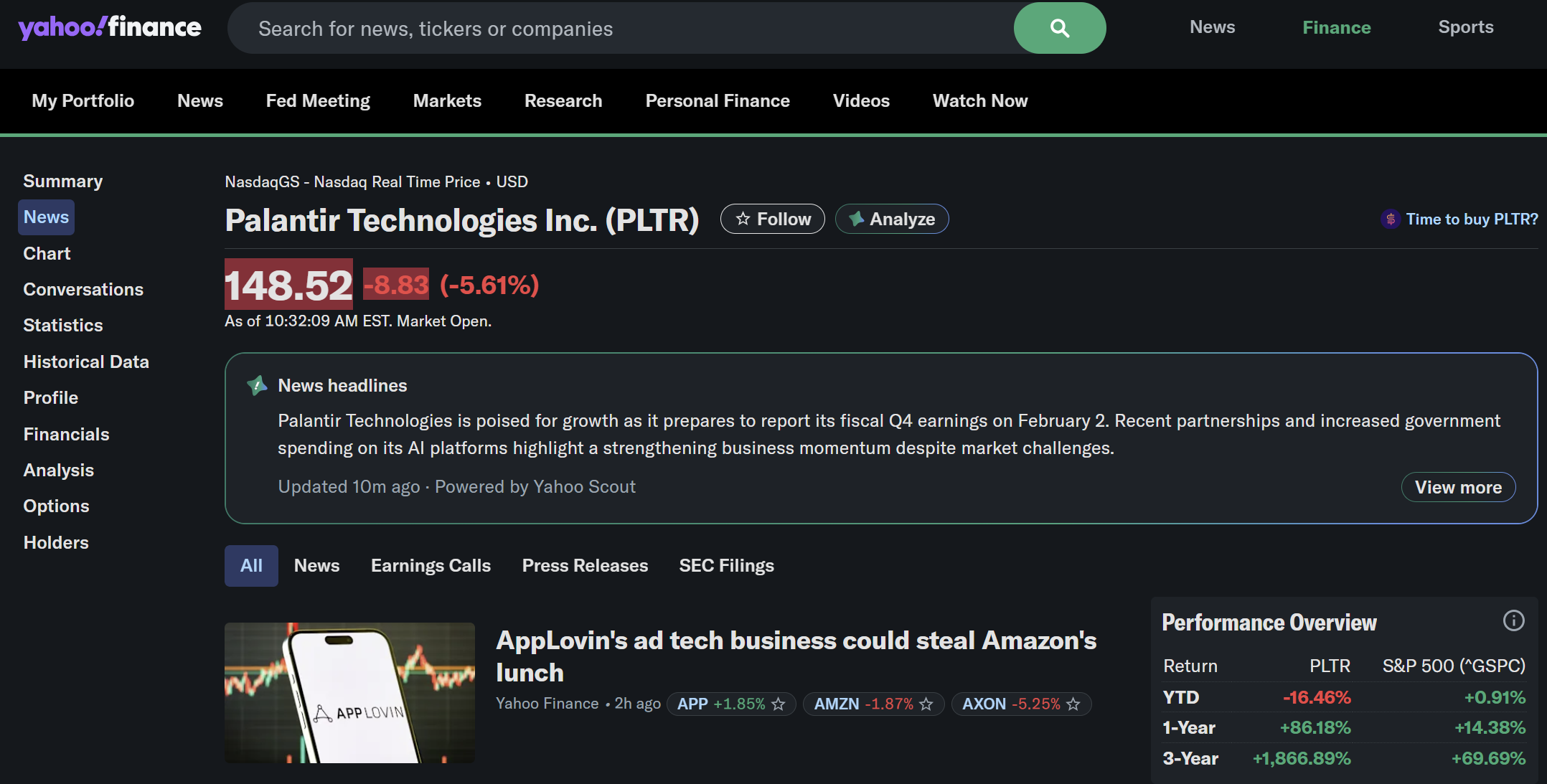

2. Palantir (PLTR): The Pre-Earnings Tug-of-War

Palantir is seeing massive intraday swings (5-8%) as we approach its earnings date in early February. The stock is caught between "AI Hype" and "Valuation Reality."

🚨 The Driver: Rumors & The "Priced in" Debate

- Contract Rumors: Social media and trading forums are buzzing with rumors of expanded government contracts (Pentagon/NHS). This is driving retail "FOMO" buying.

- Wall Street Caution: Conversely, institutional analysts are debating if the commercial adoption of AIP (Artificial Intelligence Platform) has slowed down. The fear is that the stock is "priced for perfection." Any slight miss in guidance could trigger a sharp sell-off, causing traders to hedge their positions now.

📉 Trading Strategy: Hold / Wait. Volatility is too high for a safe entry right now. Unless you are a gambler, wait until after the earnings print to see if the growth narrative holds. Do not chase the pre-earnings rally.

3. Joby Aviation (JOBY): The Short Squeeze Candidate

Joby is the wildest card of the three. The stock has been jumping without a clear earnings catalyst, suggesting a technical move driven by news and market mechanics.

🚨 The Driver: Commercial Reality & Short Covering

- Commercial Milestones: Recent news confirming concrete flight schedules with partners (like Delta or Dubai authorities) has validated the business model. The "science project" risk is fading.

- The Squeeze: Joby has historically had high short interest. As positive news hits the wire, short sellers are being forced to buy back shares to cover their losses, fueling a "Short Squeeze" rally. This creates explosive, but often temporary, upside.

📉 Trading Strategy: Trim into Strength. If you are a long-term holder, stay the course. If you are a trader, take profits during these sharp spikes. The stock will likely cool off and consolidate after the shorts are flushed out.

Summary: The Volatility Cheat Sheet

Here is your quick guide to navigating this week's action.

| Ticker | Volatility Driver | Sentiment | Actionable Advice |

|---|---|---|---|

| LMT | Geopolitics + Backlog | Bullish | Accumulate. Use as a portfolio hedge. |

| PLTR | Pre-Earnings Speculation | Neutral/Volatile | Wait. Too risky before the earnings report. |

| JOBY | News + Short Squeeze | Aggressive Bull | Trade Levels. Don't chase the green candles. |

FAQ: Trader's Questions

Q1: Should I buy PLTR calls before earnings?

A: It is high risk. The implied volatility (IV) is expensive, meaning the stock needs to move significantly just for you to break even on options. Selling puts might be a safer strategy if you are bullish.

Q2: Why is LMT moving up when the market is down?

A: This is classic "Beta rotation." When investors are scared of a market crash, they sell risky tech stocks and buy LMT because defense spending is uncorrelated to the economy.

Q3: Is the Joby rally sustainable?

A: The long-term trend is up, but the current vertical move is likely technical (short covering). Expect a pullback to test support levels before the next leg up.

[Disclaimer]

This analysis is based on market conditions and news trends as of January 30, 2026. It is for educational purposes only and does not constitute financial advice. Trading volatile stocks carries a high level of risk. Please do your own due diligence.

'취미 > 주식' 카테고리의 다른 글

| 샌디스크(SNDK) 주가, 오늘 왜 폭등했나? 실적 발표 완벽 분석 (0) | 2026.01.30 |

|---|---|

| 덕양에너젠, 수소 경제의 숨은 강자? (덕양 분할 총정리) (0) | 2026.01.30 |

| LMT·PLTR·JOBY 거래량 폭발, 변동성 장세의 원인과 대응 전략 (0) | 2026.01.30 |

| MSFT vs. META Stock Analysis: Who Wins the AI Monetization Race in 2026? (0) | 2026.01.30 |

| 미국 로봇 관련주 추천: AI와 만난 2026년 필수 투자 종목 TOP 5 및 ETF 총정리 (1) | 2026.01.29 |

댓글