Range Resources Corporation (RRC): Navigating the Energy Sector's Hidden Gem

In the dynamic world of energy investments, Range Resources Corporation stands as a compelling story of operational excellence and strategic positioning in America's natural gas revolution. Trading under the ticker symbol RRC on the New York Stock Exchange, this Fort Worth-based company has carved out a dominant position in one of the most prolific natural gas regions in the United States

Company Overview: The Marcellus Shale Pioneer

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), and oil company with a laser focus on the Appalachian region^1^3. Founded in 1976 and originally known as Lomak Petroleum, the company underwent a strategic transformation that would define its future success^4.

A natural gas drilling rig stands under a bright blue sky, illustrating the operational backbone of energy companies

The company's primary area of operations centers on the Marcellus Shale in Pennsylvania—a geological formation that has revolutionized American energy production^1. This shale formation, which Range Resources helped pioneer through early development efforts, represents one of the largest natural gas reserves in the United States^4

Key Company Metrics

- Headquarters: Fort Worth, Texas

- Employees: 565

- Primary Operations: Pennsylvania (Marcellus Shale)

- Proved Reserves: 18.1 Tcfe (trillion cubic feet equivalent)

- Daily Production: Approximately 2.2 Bcfe (billion cubic feet equivalent) per day

Recent Financial Performance: Strong Momentum Building

Range Resources has demonstrated remarkable financial resilience and growth trajectory in recent quarters. The company's Q1 2025 results showcase a business hitting its stride with impressive operational metrics^6.

RRC Stock Price Performance: 18-Month Trading History (January 2024 - July 2025)

Q1 2025 Highlights

- Revenue: $846.3 million (65% increase year-over-year)

- Operating Income: $311 million with a 36.7% operating margin

- Net Income: $97.1 million

- Cash Flow from Operations: $330 million

- Free Cash Flow: Robust generation supporting shareholder returns

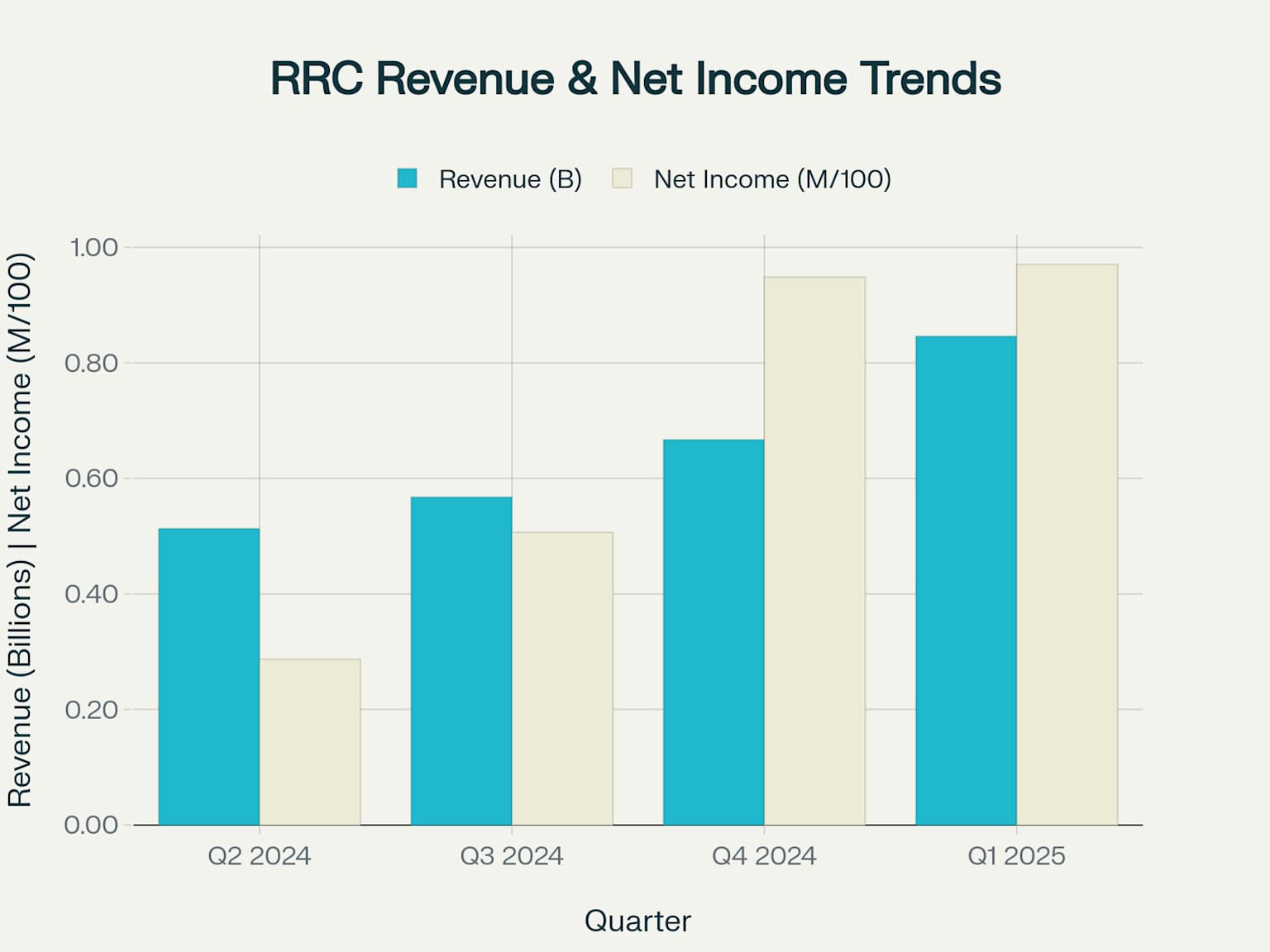

The company's quarterly revenue trend shows consistent growth momentum, with revenue climbing from $513 million in Q2 2024 to $846 million in Q1 2025^7. This represents a significant acceleration in business performance driven by both higher production and improved commodity pricing

RRC Quarterly Financial Performance: Revenue and Net Income Trends (Last 4 Quarters)

Market Position: Strategic Advantages in the Marcellus Shale

Range Resources enjoys several competitive advantages that position it favorably within the energy sector. The company operates in the Marcellus Shale, which offers some of the lowest-cost natural gas production in North America^1.

Map illustrating the proposed Borealis Natural Gas Pipeline and existing infrastructure across key natural gas-producing shale plays in the US, including the Appalachian Basin

Operational Excellence

- Low Capital Intensity: The company maintains production levels with minimal capital deployment, operating with just one completion crew for 2.2 Bcfe/d of production^8

- Geographic Concentration: Nearly 100% operated assets in Pennsylvania provide operational efficiencies and expertise^1

- Transportation Access: Strategic pipeline access to multiple markets including Midwest, Gulf Coast, and international destinations^1

The company's natural gas liquids (NGLs) operations provide additional value creation. In recent quarters, RRC achieved record NGL premiums, with Q3 2024 showing over $4 per barrel above the Mont Belvieu index—the highest in company history^8.

Industry Outlook: Riding the Natural Gas Wave

The natural gas industry outlook supports Range Resources' strategic positioning. Several macro trends favor natural gas producers, particularly those with low-cost operations like RRC

Demand Drivers

- LNG Export Growth: New liquefied natural gas facilities coming online, including Plaquemines LNG and Corpus Christi Stage 3, are expected to increase U.S. natural gas demand by 2.9 Bcf/d in 2025^9

- International Markets: Growing global demand for cleaner-burning natural gas as countries transition away from coal^11

- Domestic Consumption: Increased residential and commercial demand expected due to colder weather patterns^9

Production Outlook

The Marcellus and Utica shales are projected to maintain steady production growth, with combined output expected to reach 38.3 billion cubic feet per day by 2025^12. This positions Range Resources well within the most productive natural gas basin in the United States.

Investment Considerations: Analyzing the Opportunity

From an investment perspective, Range Resources presents both compelling opportunities and important considerations for potential investors

Strengths

- Strong Balance Sheet: Net debt reduced to $1.4 billion range, within management's target of $1-1.5 billion^8

- Shareholder Returns: Active share repurchase program with $68 million bought back in Q1 2025^6

- Dividend Sustainability: Consistent dividend payments supported by free cash flow generation^13

- Operational Efficiency: Industry-leading cost structure and production efficiency^1

Current Valuation Metrics

- Trading Range: $27.29 - $43.50 (52-week range)

- Market Capitalization: Approximately $9.2 billion

- P/E Ratio: 34.74

- Analyst Price Targets: Average around $41-42 with mostly Hold ratings^14^16

Risk Factors: Understanding the Challenges

While Range Resources demonstrates strong operational performance, several risk factors warrant investor consideration

Commodity Price Volatility:

Natural gas prices remain inherently volatile, influenced by weather patterns, storage levels, and global energy dynamics. The company's revenues directly correlate with commodity price fluctuations^1.

Regulatory Environment:

Environmental regulations and permitting requirements for drilling and pipeline infrastructure can impact operations and expansion plans^1.

Market Competition:

The shale gas industry remains highly competitive, with technological advances continuously changing the competitive landscape^1.

Looking Ahead: Strategic Positioning for Growth

Range Resources appears well-positioned to capitalize on favorable natural gas market dynamics. The company's focus on the Marcellus Shale, combined with operational excellence and financial discipline, provides a foundation for sustained value creation

Key Catalysts

- Continued production optimization and cost efficiency improvements

- Growing LNG export demand supporting natural gas prices

- Strategic infrastructure investments enhancing market access

- Disciplined capital allocation balancing growth and shareholder returns

The company's three-year growth plans emphasize incremental drilling productivity improvements and maintaining competitive cost structures^16. Management's focus on free cash flow generation and shareholder returns aligns with current market preferences for energy companies prioritizing capital discipline over growth-at-any-cost strategies

Investment Disclaimer

This blog post is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The author and publisher are not registered investment advisors, financial advisors, or tax professionals. The information presented herein is based on publicly available data and should not be considered as a recommendation to buy, sell, or hold any securities

Investing in stocks, including Range Resources Corporation (RRC), involves substantial risk of loss and may not be suitable for all investors. Past performance does not guarantee future results. Stock prices can fluctuate significantly, and investors may lose some or all of their investment. The energy sector, in particular, is subject to commodity price volatility, regulatory changes, environmental risks, and other factors that can materially affect stock performance. Before making any investment decisions, readers should conduct their own research, consider their risk tolerance and investment objectives, and consult with qualified financial advisors. The author and publisher disclaim any liability for losses or damages resulting from reliance on the information contained in this post

댓글