Steel Dynamics (STLD): A Steel Giant Forging Ahead in 2025

Steel Dynamics Inc. (NASDAQ: STLD) has been capturing investor attention in 2025 with impressive stock performance and strategic expansions that position the company for long-term growth. As one of America's largest steel producers and metal recyclers, Steel Dynamics represents a compelling investment opportunity in the industrial sector. Let's dive deep into what makes this steel giant tick and why investors are taking notice

The Powerhouse Behind American Steel Production

Steel Dynamics stands as the third-largest carbon steel producer in the United States, with an estimated steelmaking and coating capacity of approximately 16 million tons annually^1. Founded in 1993 by former Nucor executives, the company has built its reputation on innovative electric arc furnace (EAF) technology and a vertically integrated business model that sets it apart from traditional steel manufacturers.

Large steel coils stacked inside a Steel Dynamics facility, with an American flag displayed in the background.

The company operates through four primary segments: steel operations (69% of revenue), metals recycling operations (12% of revenue), steel fabrication operations (15% of revenue), and the newly established aluminum operations segment^1. This diversified approach provides Steel Dynamics with multiple revenue streams and helps mitigate risks associated with cyclical market conditions.

Strong 2025 Stock Performance Tells a Compelling Story

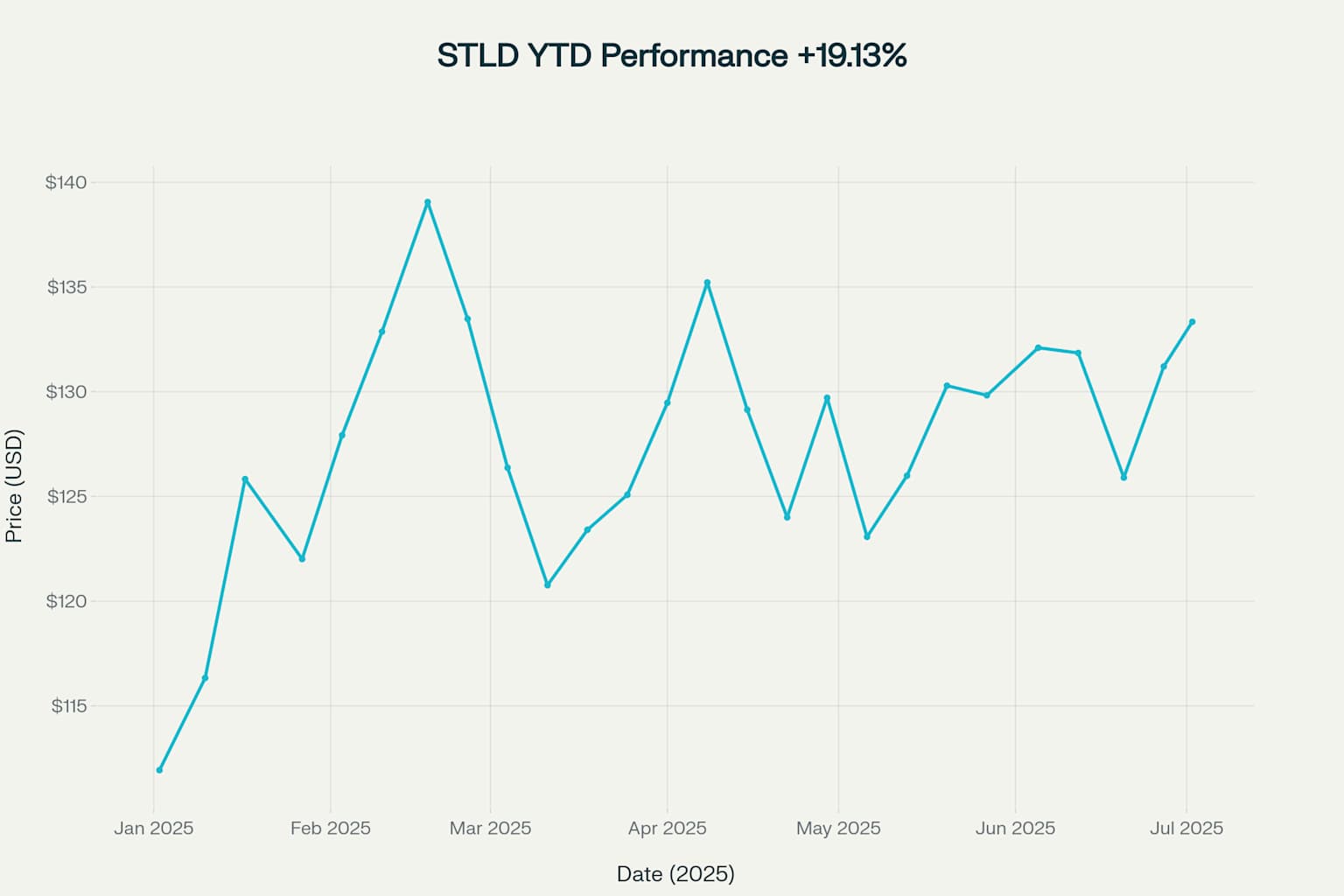

Steel Dynamics has delivered remarkable returns for investors in 2025, with the stock surging 19.13% year-to-date as of July^3. This impressive performance reflects growing investor confidence in the company's strategic direction and operational efficiency

Steel Dynamics (STLD) YTD 2025 stock performance showing strong 19.13% gains from January through July

The stock began 2025 at $111.93 and has climbed to $133.34, demonstrating resilience despite broader market volatility^3.

With a current market capitalization of approximately $19.8 billion, STLD trades at a reasonable P/E ratio of 17.56, suggesting the stock may still offer value for investors seeking exposure to the industrial sector.

Financial Foundation: Navigating Industry Cycles with Strength

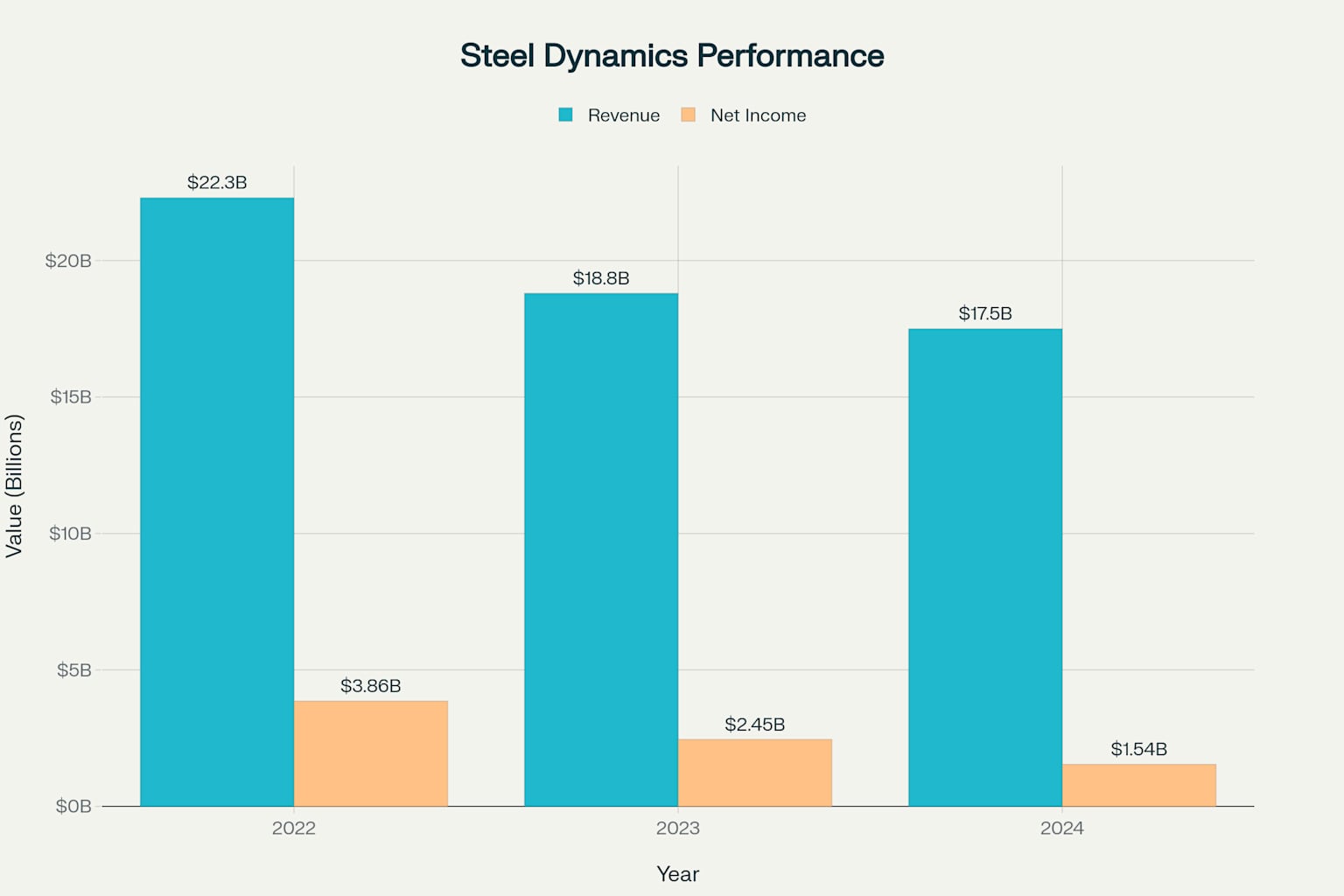

Steel Dynamics' financial performance reflects the cyclical nature of the steel industry, but the company has demonstrated remarkable resilience through market downturns. In 2024, the company reported revenue of $17.5 billion with net income of $1.5 billion, translating to earnings per share of $9.84^4.

Steel Dynamics financial performance showing declining revenue and earnings trend from 2022-2024

While these figures represent a decline from the peak performance in 2022 (when revenue reached $22.3 billion), this trend mirrors industry-wide patterns driven by fluctuating steel prices and demand cycles^5.

The company's strong balance sheet, with $2.2 billion in liquidity as of December 2024, provides a solid foundation for weathering market volatility and funding growth initiatives^4.

Key Financial Metrics (2024)

- Revenue: $17.5 billion

- Net Income: $1.5 billion

- EBITDA: $2.5 billion

- Operating Margin: 11.1%

- Strong liquidity position: $2.2 billion

Revolutionary Electric Arc Furnace Technology: The Green Steel Advantage

Steel Dynamics' competitive edge lies in its advanced electric arc furnace technology, which produces steel using recycled ferrous scrap as the primary input^6. This process, known as "mini-mill" steelmaking, offers significant environmental and cost advantages over traditional blast furnace methods.

Electric arc furnace in operation at a Steel Dynamics steel mill, showcasing the intense heat and advanced technology used in steel production

EAF technology allows Steel Dynamics to produce lower-carbon-emission steel while maintaining cost competitiveness. The process typically consumes 55-65% less energy than traditional steelmaking methods, positioning the company favorably as environmental regulations tighten and customers increasingly demand sustainable products^1.

The $2.7 Billion Aluminum Gambit: Diversification into New Markets

One of Steel Dynamics' most ambitious strategic initiatives is its entry into the aluminum market through a $2.7 billion investment in recycled aluminum flat-rolled products manufacturing^7. The project includes:

- A 650,000-metric-ton aluminum flat-rolled mill in Columbus, Mississippi

- Two satellite recycled aluminum slab centers in Arizona and Mexico

- Expected production start in mid-2025

Large coils of aluminum flat rolled products are stored and processed in a manufacturing facility

This expansion addresses a significant supply deficit in North American flat-rolled aluminum, estimated at over 2 million metric tons^9. The new facilities will serve three key markets: beverage cans (45%), automotive (35%), and industrial applications (20%)^7. This strategic diversification reduces Steel Dynamics' dependence on steel markets alone while tapping into growing demand for sustainable aluminum products.

Metals Recycling: The Circular Economy Champion

Steel Dynamics operates one of the largest metals recycling platforms in North America through its OmniSource subsidiary^6. This vertical integration provides several competitive advantages:

- Steady supply of raw materials for steel production

- Reduced dependence on external suppliers

- Lower transportation costs

- Enhanced supply chain resilience

A large pile of various scrap metal at a recycling facility, with an industrial crane in the background

The recycling operations process both ferrous and nonferrous metals, with approximately 63% of recycled ferrous scrap utilized in the company's own steel mills^10. This circular business model not only supports sustainability goals but also provides cost advantages during periods of volatile raw material prices.

Market Position and Competitive Advantages

Steel Dynamics has established several key competitive advantages that strengthen its market position

Geographic Strategy: The company strategically locates its facilities near both scrap metal sources and customer bases, reducing freight costs and delivery times^1.

Product Diversification: With offerings ranging from hot-rolled and cold-rolled steel to specialized products for automotive and energy sectors, Steel Dynamics serves multiple end markets^1.

Operational Efficiency: The company's entrepreneurial culture and performance-based compensation system drive continuous improvement and innovation^1.

Value-Added Services: Through facilities like The Techs and Heartland Flat Roll Division, Steel Dynamics provides coating and processing services that command premium pricing^1.

Industry Outlook and Growth Catalysts

The steel industry in 2025 is experiencing several positive trends that could benefit Steel Dynamics

Infrastructure Investment: Continued U.S. infrastructure spending supports demand for structural steel products^11.

Onshoring Trends: Manufacturing reshoring initiatives drive demand for domestic steel production^11.

Trade Protection: Section 232 tariffs on steel imports provide a competitive advantage for domestic producers^12.

Green Steel Demand: Growing emphasis on sustainability creates opportunities for EAF-produced steel^13.

Analyst Perspective and Price Targets

Wall Street analysts maintain a generally positive outlook on Steel Dynamics, with consensus ratings of "Moderate Buy" to "Buy"^14. Price targets range from $128.91 to $165 per share, suggesting potential upside from current levels^12. Key factors supporting analyst optimism include

- Strong operational execution

- Successful aluminum expansion

- Defensive positioning in cyclical markets

- Consistent shareholder returns through dividends and buybacks

The company has maintained dividend payments for 22 consecutive years and recently increased its quarterly dividend by 9% in 2025^3.

Risk Factors to Consider

Despite its strengths, Steel Dynamics faces several risks that investors should consider:

Cyclical Industry Exposure: Steel demand and pricing remain sensitive to economic cycles and construction activity^12.

Raw Material Costs: Fluctuations in scrap metal prices can impact margins, particularly during periods of tight supply^12.

Import Competition: Despite tariff protection, steel imports continue to pressure domestic pricing^11.

Execution Risk: The large-scale aluminum expansion requires successful project execution and market penetration^7.

The Investment Thesis: Building on Solid Foundations

Steel Dynamics presents a compelling investment case built on several key pillars:

- Market Leadership: Established position as a top-three U.S. steel producer with modern, efficient facilities

- Strategic Diversification: Aluminum expansion reduces dependence on steel cycles while accessing growing markets

- Operational Excellence: Proven track record of navigating industry cycles with strong cash generation

- Shareholder-Friendly Management: Consistent dividend growth and share buyback programs

- Sustainability Positioning: EAF technology aligns with environmental trends and regulatory requirements

The company's 2025 stock performance demonstrates investor confidence in this strategy, but the true test will be successful execution of the aluminum expansion and continued operational excellence in core steel markets

Investment Disclaimer: This analysis is for informational purposes only and should not be considered as personalized investment advice. Investing in individual stocks, including Steel Dynamics (STLD), carries inherent risks including potential loss of principal. Steel and metals companies are particularly subject to cyclical market conditions, commodity price volatility, regulatory changes, and economic fluctuations that can significantly impact stock performance. Past performance does not guarantee future results. Before making any investment decisions, investors should conduct their own research, consider their risk tolerance and investment objectives, and consult with qualified financial advisors. The author may or may not hold positions in the securities discussed.

댓글